Digital Ticks (DT) a proprietary trading software of MuGenesys Software Pvt Ltd. It is an advanced, enterprise-scale trading system, meticulously crafted to transform your retail broker-dealer, proprietary, and institutional trading operations. From front to middle-office management, Digital Ticks seamlessly addresses every facet, enhancing your business efficiency, performance, transparency, and competitive advantage.

"MuGenesys Software Pvt Ltd. is an Empanelled software Vendor of NSE."

Enhances efficiency, performance, transparency, and competitiveness.

Top-tier assistance to ensure your technology needs are met with unparalleled expertise.

Low latency high-performance desktop- app with sophisticated OEMS.

Seamless experience across exchanges and liquidity providers.

Our different systemcombined, ensures seamless execution and monitoring of transactions. These capabilities collectively empower the business to offer streamlined and reliable services essential for navigating dynamic financial markets with confidence and precision.

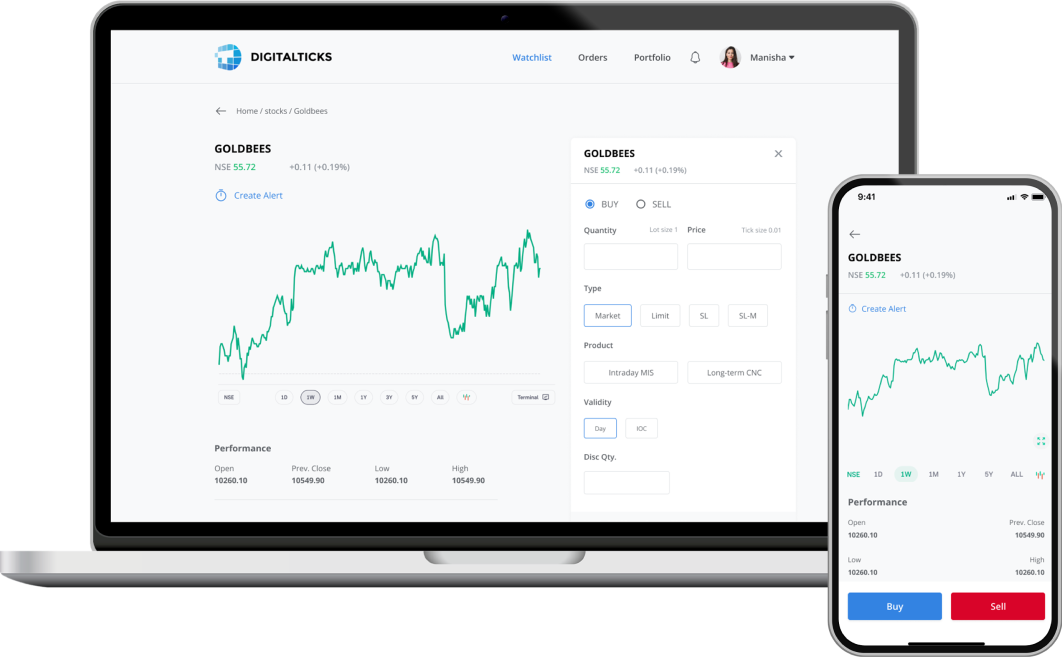

Get Started Download Our AppTrading platforms designed for all major Indian stock exchanges. Having user-friendly and efficient trading terminals can indeed be a game-changer for traders, especially when navigating the complexities of the stock market. With terminals like Digital Ticks (IBT) and DT Web & Mobile App (STWT), traders can access real-time market data, execute trades swiftly, and manage their portfolios effectively. These platforms can help traders stay competitive and capitalize on market opportunities.

Our advanced trading terminals support the following segments on the NSE:

Our advanced trading terminals support the following segments on the BSE:

Our advanced trading terminals support the following segments on the MCX:

Application Programming Interfaces used to facilitate data retrieval, trading execution, and integration of financial services into applications.

Convenient access for trading, portfolio management, and real-time market updates.

Algorithmic Trading helps to automated trading systems that execute orders based on pre-defined criteria and mathematical models.

And gain access to a cutting-edge trading platform designed for the modern investor and traders. Experience seamless transactions, real-time market data, and powerful tools for managing your investments efficiently.